MEPCO KYC | Secure Your MEPCO Connection:

The digital landscape of utility services in Pakistan is rapidly evolving. For millions of consumers in South Punjab, the Multan Electric Power Company (MEPCO) has taken a significant step toward modernizing its records and ensuring data accuracy by introducing the Know Your Customer (KYC) verification system.

Multan Electric Power Company (MEPCO) has introduced an important MEPCO KYC verification system on its official website. This initiative is in line with the decisions of the Prime Minister and the Federal Minister for Power.

1. What is MEPCO KYC and Why is it Necessary?

KYC (Know Your Customer) is a regulatory compliance process traditionally used by financial institutions (like banks) to verify the identity of their clients. Its implementation by a major electricity distribution company like MEPCO signals a shift toward enhanced digital security and operational transparency.

For MEPCO, the system is designed to link every electricity connection accurately to its respective owner using the Computerized National Identity Card (CNIC), the primary identification document in Pakistan.

KEY Points & Core Purpose:

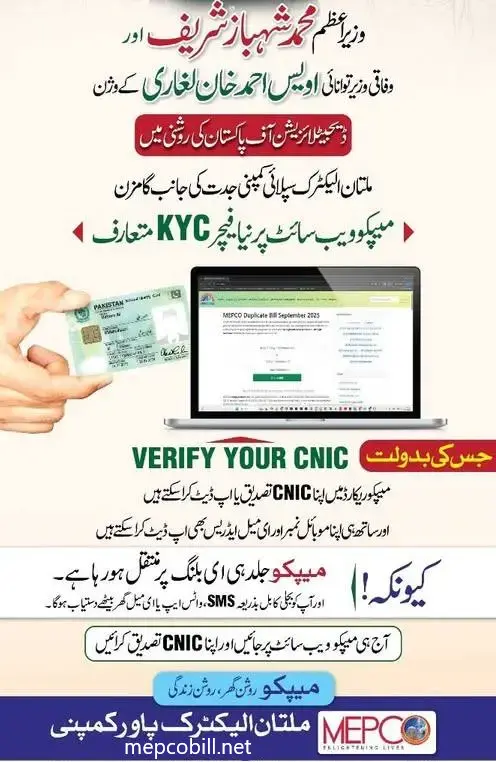

Multan Electric Power Company (MEPCO) has introduced a MEPCO KYC system for consumers on the website. Now you can register and verify your electricity connection online using your National Identity Card number, so that all records are accurate and secure.

Register your ID card details on the website, update your mobile number, and get the e-bills facility. All MEPCO records are being transferred into the e-banking system. Therefore, you may face problems if you are not verified. Complete your verification today and enjoy the benefits of modern facilities related to your electricity bills.

| Key Points | Corresponding Action in MEPCO KYC |

| Identity Verification | Registering CNIC details online. |

| Contact Data Integrity | Updating the current mobile number. |

| Digital Migration | Transferring physical billing records to the e-banking system. |

| Consumer Due Diligence | Ensuring every connection is securely registered to an authenticated user. |

The fundamental necessity stems from the push for digital migration. As MEPCO increasingly moves all its service and billing records into the electronic and e-banking ecosystem, authenticated customer data is essential for secure, automated service delivery and fraud prevention.

2. Key Requirements for MEPCO Consumer Verification

The core of the MEPCO verification system is simple, focusing on three essential data points:

- Valid CNIC Number: The 13-digit National Identity Card number of the current connection holder. This is the main point of the KYC process, ensuring the record is tied to a verifiable national identity.

- Active Mobile Number: A current and accessible mobile phone number to receive important updates, One-Time Passwords (OTPs), and billing notifications via SMS.

- MEPCO Reference Number: The 14-digit reference number found on any previous or current MEPCO bill, which uniquely identifies your electricity connection.

3. The Step-by-Step Process for Online KYC Registration

The user-friendly online system is designed to be completed quickly, ensuring minimal disruption. While the official interface may vary slightly, the functional steps remain the same:

Phase 1: Registration and Data Submission

- Access the Portal: Navigate to the official MEPCO consumer portal or the designated KYC verification link (usually found on the official MEPCO website).

- Enter Connection Details: Input your 14-Digit MEPCO Reference Number to retrieve your consumer details from the database.

- Provide CNIC: Enter your CNIC Number and ensure it accurately matches the primary account holder’s details.

- Update Contact Information: Input your active mobile number and, optionally, your email address. This step is crucial for activating the e-billing facility.

Phase 2: Data Authentication and Confirmation

- The system cross-references the submitted CNIC data with national database records to confirm identity.

- Once authentication is successful, you will receive a confirmation, and your record will be tagged as MEPCO KYC Verified.

4. Mandatory Benefits of Completing Your MEPCO KYC

Completing the KYC process is not just a regulatory obligation; it unlocks several practical benefits that significantly improve your consumer experience and billing security.

| Benefit Category | Impact on Consumer |

| Access to E-Bills Facility | Receive your electricity bill digitally (via email or SMS), eliminating the risk of lost paper bills and ensuring timely payments. |

| Secure Digital Transactions | Facilitates seamless and secure online payments through e-banking apps (e.g. Jazz Cash, Easy Paisa) and bank portals, as your verified mobile number becomes a secure anchor point. |

| Accurate Record Keeping | Guarantees that the electricity connection record is correctly linked to the legal owner, simplifying matters of transfer, change of name, or meter replacement. |

| Improved Complaint Resolution | Faster and more efficient complaint lodging (via the MEPCO Light or CCMS+ systems) because your identity and contact details are already verified in the system. |

| Timely Communication | Ensures you receive crucial updates regarding load shedding schedules, payment deadlines, and power outages directly on your registered mobile number. |

5. Potential Consequences of Non-Verification

The key information provided stresses the importance of timely verification. As MEPCO transitions all records to the secure e-banking system, non-verified accounts may face significant service impediments.

Consumers who fail to complete the MEPCO KYC process risk the following:

- Disruption in Digital Payments: Banks and e-wallets may eventually restrict or suspend bill payments for unverified accounts to comply with updated regulatory (SBP/NADRA) standards.

- Loss of E-Billing Notifications: You may lose access to convenient e-bill notifications, relying solely on paper bills which are often delayed or lost.

- Administrative Hurdles: Any future request for a meter shift, load change, or connection transfer will be significantly delayed or rejected until the KYC profile is compliant.